NY DOS-1450-f-l-a 2010-2025 free printable template

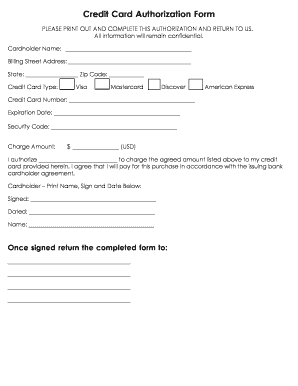

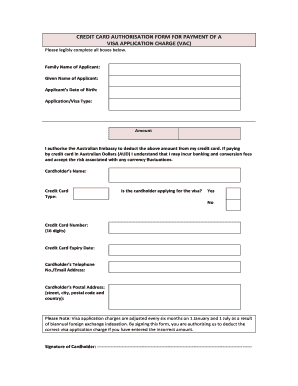

Get, Create, Make and Sign ny credit card authorization form

Editing dos 1450 fla form online

How to fill out dos 1450 f l a form

How to fill out NY DOS-1450-f-l-a

Who needs NY DOS-1450-f-l-a?

Video instructions and help with filling out and completing credit card authorization template

Instructions and Help about new york credit card authorization form

Good day my name is Matt Crawford and×39’m with quadrant merchanservicetodayay IN×39’m going to take a few moment sand talk about the phrase credit card authorization and what we mean by that phrase in very simple terms as merchant when I accept a credit card for payments or services I need to make sure that that card is valid it hasn't been reported lost or stolen there is available credit on the card to do that need a credit card authorizationnumberthe most common way that number is provided in today's retail environments through the point-of-sale device that device you see on the counter of every retail merchant you×39’ve ever gotten there Virgin takes my card depending on the terminal they're using they swipe it meeting the mag stripe is red where they insert the card into the terminal meaning the chip is red once that happens the transaction is routed through the merchants credit card processor it is routed to Visa and or MasterCard depending on the card type, and it finally ends up with the cardholder or my customers issuing bank that issuing Bank says yes the transaction is good or the transactions authorized or now the transaction is invalid all that information is then sent back to me at the merchant to buypoint-of-sale device and literally in seconds I have a credit card authorization that authorization appears as a number on the receipt it's a number may need to refer back to if their×39’s chargeback some sort of dispute so today where the merchant needs a credit card authorization they do it through theirpoint-of-sale device for interest’s sak3lullllll quickly outline how it was done in the past in the past merchants had floor limit meaning if the transaction was below their floor limit they didn't×39;have to get the credit card authorized if the transaction was the Bob therefore11they had to pick up the phone and call the credit card processor to validate that transaction or to authorize that transaction that was obviously a verytime-consuming process and a big part of why we've come to increasing rely on point of sale devices to get that credit card authorization so is very simple terms we use the phrase credit card authorization we're simply talking about merchants having the confidence to know that that credit card is valid, and they will get paid for their sale thank you very much

People Also Ask about new york credit authorization form

Is it safe to give credit card authorization form?

Are credit card authorization forms required?

What is credit card authorization form?

Why do hotels require credit card authorization form?

How to create credit card authorization form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file credit card authorization template?

How to fill out credit card authorization template?

What is the purpose of credit card authorization template?

What information must be reported on credit card authorization template?

How do I modify my credit card authorization form ny in Gmail?

Where do I find new york credit card authorization?

Can I edit new york credit authorization on an Android device?

What is NY DOS-1450-f-l-a?

Who is required to file NY DOS-1450-f-l-a?

How to fill out NY DOS-1450-f-l-a?

What is the purpose of NY DOS-1450-f-l-a?

What information must be reported on NY DOS-1450-f-l-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.